Once upon a time — way back in the DVD-by-mail era — Netflix (NFLX 3.74%) was all about movies. TV shows became a second focus when the company started producing its own content for the digital video-streaming service. That was a decade ago and Netflix has pursued those two target markets with an adamant fixation ever since.

But things are changing again. Now, Netflix sees itself as the once and future king of three media types. Films and TV shows have been joined by video games, and co-CEO Reed Hastings can’t stop talking about this new direction.

Straight from the CEO’s mouth

This week, Hastings sat down for a long interview with The New York Times journalist Andrew Ross Sorkin at the newspaper’s DealBook conference. Games came up often in this discussion, often as a passing reference by Hastings. The executive jumped on every chance to reinforce the message that Netflix wants to be a leading provider of movies, series, and games.

“We want the brain to be the most exciting entertainment on Earth, the place you go when you really want emotional stimulation. For us, that’s around film, series, and games.” Hastings said in one typical passage. “In two of those, we’re strong. And we’re just beginning in games.”

A few minutes later, Sorkin asked about Netflix’s plans for live sports content. Apple and Amazon are spending billions of dollars on this type of content right now, so why shouldn’t Netflix follow suit?

Hastings didn’t bite on that line and steered the discussion right back to video games instead.

“Talk to us after we’re like a big leader in games,” he said. “We got a lot of investment to do in games.”

In particular, Hastings wants his company’s gaming experience to focus purely on fun gameplay, not monetization. The “freemium” game model has become incredibly popular in recent years, offering completely playable games for free but with the caveat that you’ll be more successful or have more fun if you spend money on in-game items.

“That distracts from the engagement and our theory is we can build games just around engagement that are really awesome,” Hastings said.

Don’t expect any freemium games in the Netflix collection, in other words. The idea here is to create an enjoyable experience with a subscription-style sales model. The cleaner and crisper this experience feels from the customer’s point of view, the more subscribers will flock to the video game service.

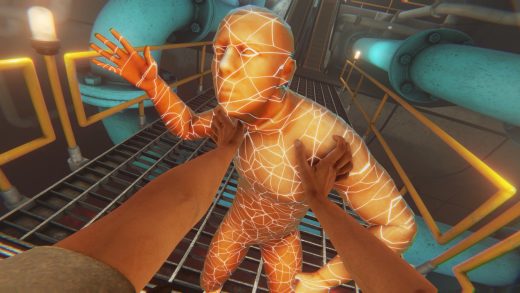

Most of Netflix’s games are played on mobile devices. Image source: Getty Images.

The gaming story so far

Netflix may not have much experience in the video game field yet, but that’s not for lack of effort. Hastings and friends are trying out many different approaches to the new market from various angles. As a result, Netflix games are in everything, everywhere, all at once.

The company has acquired four game development studios so far. Another studio was started from scratch in Helsinki, Finland.

The in-house studio is hiring developers and project managers with proven experience from so-called AAA games — surefire big-budget blockbusters from major developers. The obvious ambition is to create more of those big-ticket titles as exclusive Netflix games.

Netflix also has development deals with gaming industry giants like Assassin’s Creed maker Ubisoft. Altogether, Netflix announced 13 mobile games over the last three months alone.

And that’s not all. Interactive videos such as the acclaimed Black Mirror: Bandersnatch should be counted in the game category, too. There are 24 of these choose-your-own-adventure titles so far. Some of them go beyond the interactive story format, including trivia games you can play with your smart TV remote.

What Netflix investors should look for

So Netflix is doing everything in its power to establish a serious presence in the gaming industry. One of these days, I expect the games to become a separate subscription service instead of a free add-on for video-streaming customers. That announcement may be controversial, like the Qwikster debacle that moved digital streaming up from a free feature of the DVD-mailer service to kick-start the giant streaming business that exists today.

The Qwikster launch was clumsy at best and the gaming service launch will probably be less dramatic. But if that event triggers a brutal sell-off, like the Qwikster introduction did, I’ll be first in line to pick up Netflix shares on the cheap. The stubs I picked up in the fall of 2011, at a 73% discount to the all-time highs at the time, have made me a lot of money over the years.

I sure wouldn’t mind another bargain-bin opportunity like that:

There’s no need to wait around for another price drop, though. Netflix stock is already a great buy at today’s prices.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Amazon.com and Netflix. The Motley Fool has positions in and recommends Amazon.com, Apple, and Netflix. The Motley Fool recommends Ubisoft Entertainment and recommends the following options: long March 2023 $120 calls on Apple and short March 2023 $130 calls on Apple. The Motley Fool has a disclosure policy.