US consumers are downloading fewer mobile games this year than last, thanks to a combination of factors, including the end of COVID restrictions, and rapidly-rising inflation.

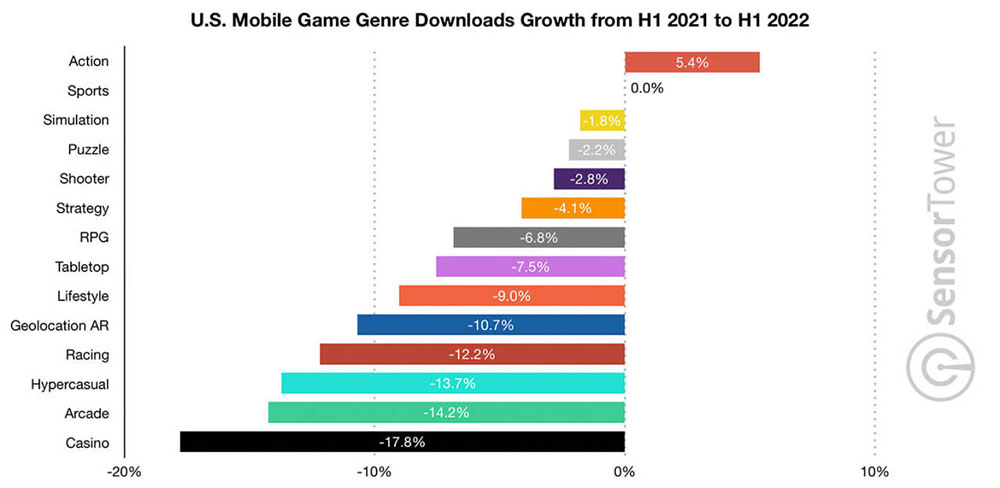

Of 14 mobile games genres tracked by app analytics company Sensor Tower, only one saw increased downloads in the first half of 2022, and there were steep declines in most others …

Sensor Tower measured downloads and revenue, and both were down in the first half of this year compared to the same period in 2021.

Most mobile game genres in the United States saw player spending and downloads decline during H1 2022 as the market fell by 9.6 percent year-over-year to $11.4 billion, Sensor Tower Game Intelligence data reveals.

Mobile games downloads

The Action genre was the only one to see a year-on-year increase in downloads across both iOS and Android.

The Action genre saw the fastest growth in downloads during the first half of the year compared to the same period in 2021, rising by 5.4 percent Y/Y to 54.7 million.

The top Action subgenre for downloads was Action Sandbox, which saw downloads climb by 2.3 percent Y/Y to 15.7 million installs.

The No. 1 Action game for downloads was Genshin Impact from miHoYo, which accumulated 2.3 million downloads, followed by Galaxy Attack: Space Shooter from Rocket Go Global at No. 2 and Galaxy Attack: Alien Shooter, also from Abigames, at No. 3.

Sports held its own, with downloads flat, while Simulation, Puzzle, and Shooter saw modest decreases. Things get progressively worse from there.

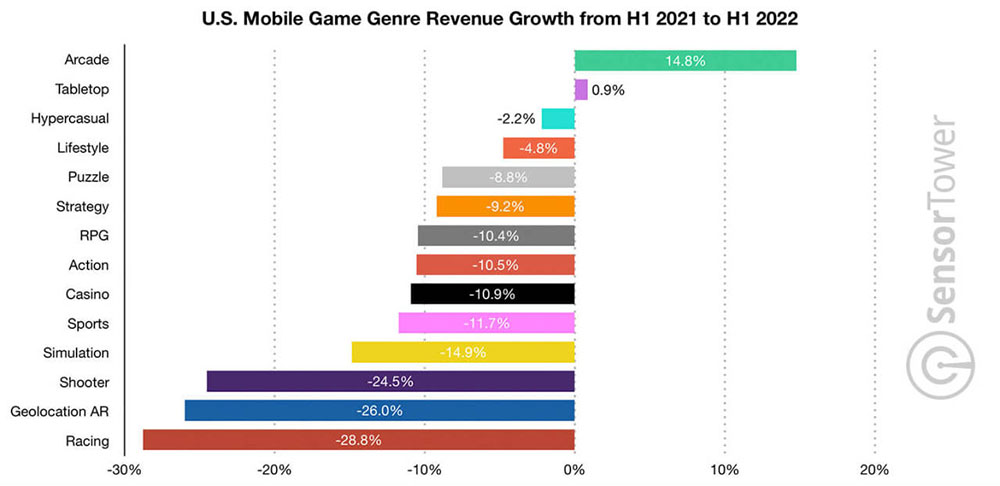

Revenue

The picture is even gloomier when looking at revenue.

Arcade was the fastest rising genre, with player spending up 14.8 percent Y/Y to approximately $176 million. The largest Arcade subgenre for player spending was Idler, which generated close to $88 million, up 35.3 percent Y/Y. The No. 1 Arcade game by player spending was Clawee from Gigantic, which generated $16.5 million in the U.S. during the first half of the year. It was followed by Gold & Goblins from AppQuantum Publishing at No. 2, and Idle Mafia from Century Games at No. 3.

The second fastest-growing genre by revenue in 1H22 was Tabletop, which increased by approximately 1 percent Y/Y to close to $388.8 million. All other mobile game genres saw a decline in overall player spending during the first half of the year, with Racing seeing the steepest decrease at 28.8 percent.

Puzzle was the largest category by spending in 1H22, picking up $2.3 billion billion, a fall of 8.8 percent Y/Y. It was followed by Casino at No. 2, which generated $2.2 billion, and Strategy, which accumulated $2 billion.

Some of the reasons for the decline are obvious. With the country reopening after COVID lockdowns, there are many more entertainment options available than there were when people were stuck at home and many venues were closed.

Inflation, too, has hit hard, with consumers seeing their spending power fall off a cliff. The economic uncertainties surrounding that also means people are controlling their spending even if they are currently doing fine.

But Sensor Tower says that Apple’s App Tracking Transparency is taking its revenue toll too. Without iPhone owners consenting to tracking, free apps can no longer sell personalized ad spots, meaning ad networks pay them significantly less to run generic ads.

Photo: Screen Post/Unsplash

FTC: We use income earning auto affiliate links. More.